Extraordinary Support for Progressive Activity Resumption

(Extension 1st half of 2021)

What is the mechanism to support the gradual recovery?

It is intended to employers who have been affected by the COVID -19 disease pandemic and who are consequently in a business crisis situation, with a turnover drop of 25% or more.

The employer can access the extraordinary support for the progressive resumption of activity with temporary reduction of the normal work period of all or some of their workers.

As of january 2021, it also covers members of statutory bodies who perform management functions, which are listed on remuneration statements, and provided that the employer has at least one employee in service.

How is the breakdown of invoicing measured?

The break in invoicing is measured by comparing the invoicing in the full calendar month immediately preceding the calendar month to which the initial request for support or extension refers and:

• the homologous month of the previous year;

• the same month in the year 2019;

• the monthly average of the six months preceding that month.

For those who have started the activity less than 24 months ago, the break in invoicing is measured against the average monthly invoicing recorded in the E-fatura between the start of activity and the penultimate complete month prior to the calendar month to which the initial request for support or extension refers.

Example 1: if the request is delivered in february 2021, for the month of january 2021, the invoicing between the 1st and the 31st of december 2020, compares with the invoicing of:

• December 1 to 31, 2019 (the same month as the previous year);

• June 1 to november 30, 2020 (average of the six months prior to this period).

Example 2 (companies in active for less than 24 months): if the application is submitted in february 2021 for the month of january 2021 and the company has been active for less than 24 months, for example since 1 march 2020, the invoice must be compared between 1 march 2020 and the last but one complete month preceding the calendar month to which the initial application for support refers march 1, 2020 to november 30.

To which companies does it apply?

Employers in a situation of business crisis who have the situation regularized before the social security and the tax authority, to which private law applies – commercial companies, regardless of the corporate form, cooperatives, foundations, associations, federations and confederations – including those with the status of private institution of social solidarity, self-employed workers who are employers and statutory members.

Who can not access?

- Entities connected to offshore:

- Self-employed workers, in that capacity;

- Statutory members of companies in that capacity who are not employees.

What are the consequences for workers?

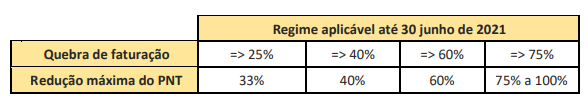

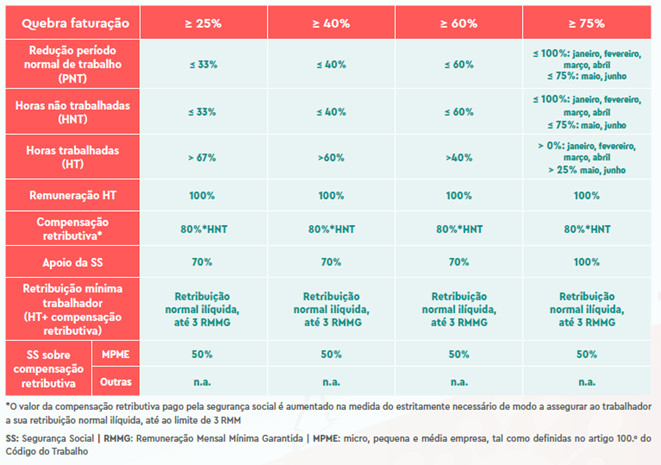

The maximum reduction of the normal working period is variable according to the breakdown of invoicing, with the following limits:

In the case of an employer with a break in invoicing of 75% or more, the reduction of the normal working period, per worker, can be a maximum:

• up to 100% in the months of january, february, march and april 2021

• of 75%, in the months of may and june 2021

The management of the reduction of the normal work period can be articulated between the employee and employer, taking into account the following rules:

✓ the application of the normal working period reduction, per employer, is always determined for a full calendar month (duration of support), regardless of the possibility of monthly extension, and measured in average terms, per worker, at the end of each month;

✓ The employer must determine the employee’s working hours and draw up a new work schedule in accordance with the percentage of reduction previously reported

✓ The duration of the normal working period during the month, within the maximum reduction limits allowed by the support, does not have to be fixed, for example, the employer may choose to concentrate the reduction on certain days of inactivity or privilege that the reduction is made with reference to the normal daily and weekly working period, that is, applying an equal reduction period on each working day or on each week;

✓ the maximum limits of the normal daily and weekly work period legally established may never be exceeded, and the worker may not work more than 8 hours a day and 40 hours a week, or the limits established in the applicable collective labor regulation instrument;

✓ Regardless of how the reduction of the normal working period is managed, at the end of the month, on average, the worker may not have provided more work than that declared when submitting the application for support, under penalty of non-compliance.

What is the remuneration due to the workers covered?

During the reduction of the normal working period, the worker is entitled:

• to the remuneration corresponding to the hours worked

• to a compensation for hours not worked with the maximum limit corresponding to three times the value of RMMG (1,995€).

The total monthly amount actually earned by the employee (compensation for hours worked + compensation for wages) may not be less than the employee’s normal. If this happens, the amount of compensation paid by social security is increased to the extent strictly necessary in order to ensure that compensation, up to a maximum of three times the gross normal salary of RMMG, without additional charges to employers.

What support is given to companies?

During the reduction of the normal working period the employer is entitled to financial support, under which the social security contributes 70% of the amount of compensation to which employees with reduced normal working period are entitled for hours not worked, the employer being responsible for ensuring the remaining 30%.

In situations where the normal working period reduction is greater than 60%, the social security contributes 100% of the amount of compensation to which workers with reduced the normal working period are entitled for hours not worked.

For companies in a situation of corporate crisis with a drop in turnover of 75% or more, the employer is entitled to additional support in which the social security will contribute 35% of the normal gross pay for hours worked due to each worker with a reduction of the normal working period.

The sum of the financial support to the compensation and this additional support cannot exceed three times the RMMG (1,995€).

Are the companies covered exempt from social security contributions?

These amounts are considered as labor income and are subject to withholding tax, according to the income tax tables in force.

However, and during the application of the measure, micro, small and medium-sized companies are entitled to partial exemption (50%) of the payment of social security contributions payable by the employer on the amount of the compensation payment in relation to the amount provided for in no. 2 of art. 6 of decree-law no. 46-a/2020.

The payment of workers contributions is maintained in full.

What is meant by normal gross remuneration?

The calculation of compensation is made in proportion to hours not worked and considers, as gross normal pay, all the regular remuneration components normally declared to social security and usually paid to the employee, relating to:

A) Basic remuneration (code “P”);

B) Monthly premiums (code “B”);

(c) Regular monthly allowances, including shift work (code “M”);

(d) Meal allowance, where this is part of the concept of remuneration (code “R”);

E) Night work (code “T”).

Rules for calculating compensation:

- The compensation corresponds to 4/5 of the monthly value corresponding to the hours not worked

- If the value resulting from the previous calculation is greater than 3 x RMMG, then the compensation will be equal to 3 x RMMG (maximum limit); if the value resulting from the previous calculation is less than the employee’s gross normal salary, then the value of the compensation paid by social security is increased to the extent strictly necessary to ensure that salary, with the maximum limit equal to 3 x RMMG (minimum limit);

- The total amount owed to the worker corresponds to the sum of the retributive compensation and the retribution corresponding to the hours worked;

- The remuneration compensation calculated on the basis of the 4/5 of the salary of the gross normal salary is shared 70% by the social security and 30% by the employer, with the social security covering the remainder of the remuneration up to the value of the gross normal salary of the worker with the limit of 3 x RMMG.

- In situations where there is a 75% or more drop in invoicing, social security provides additional support corresponding to 35% of the remuneration corresponding to the working hours provided, and the sum of this support with the contribution of the remuneration compensation may not exceed 3 x RMMG.

Aggregation of support

The employer cannot benefit simultaneously from this support and from the support provided for in decree-law no. 10-G/2020 of 26 march (simplified layoff).

Under this mechanism is it possible to suspend the employment contract?

This support can only be granted with a reduction of the normal working period, and the employer cannot temporarily suspend the contracts.

Until when does the support mechanism for

progressive recovery apply? This support, with temporary reduction of the normal working period, lasts for one calendar month and can be extended until june 30, 2021.

The interruption of the temporary reduction of the normal working period is possible and it is important to suspend the support.

it is made through changes to the request, through the functionality available in the direct social security, which allows to remove workers from the request and add again with the respective correction of the normal working period reduction.

The suspension of the support does not affect the possibility of extension of the support, since it can be requested in interpolated months.

Until when should the application be submitted?

The application can be submitted until the end of the month following the one to which the initial request for support or extension refers.

For example, the employer may submit the application by the end of february 2021 with reference to the month of january 2021.

Note: the employer that starts the application of the normal working period reduction before the social security decision on the application, takes the effects of the eventual rejection of the application.

To what duties are the employer that is the beneficiary of the support subject?

A) to maintain, demonstrably, the social security and ta regularized tax situations;

B) Make the payment of the compensation, as well as the increase that derives from the

C) Pay social security contributions and contributions on the wages received by workers;

D) Not to increase the retribution or other patrimonial benefit attributed to members of social bodies, while the social security co-participates in the retributive compensation attributed to workers;

E) Prohibition to terminate work contracts under the modalities of collective dismissal, dismissal for termination of the job, or dismissal for maladjustment, nor to initiate the respective procedures, during the reduction period, as well as in the following 60 days;

F) Prohibition of distributing dividends, in any form, namely by way of withdrawal on account, during the reduction period, as well as in the 60 following days;

G) It may not make false statements when granting the support;

H) May not require the provision of work to a worker covered by the normal working period reduction beyond the number of hours declared in the application.

Sources: