Flexibility in the Payment of Taxes and Social Contributions (2nd quarter 2020)

In view of the epidemiological situation that the country is going through and in an attempt to minimize its effects, in view of the fiscal calendar, payment obligations for the second quarter of 2020, the following measures were adopted:

1 - Payment of VAT/ IVA and withholding tax on IRS and IRC

The payment of VAT/ IVA (applicable to the normal monthly and quarterly regimes) and of withholding taxes on IRS and IRC, can be made: immediately or in a fractional way in 3 or 6 monthly installments without interest.

Who can benefit?

- All companies and independent workers with turnover up to (<=) € 10M in 2018;

- All companies and self-employed workers whose activity falls within the closed sectors;

- All companies and self-employed persons who have started / restarted activity in 2019;

- The remaining companies and self-employed workers, as long as the break exceeds 20% of the invoicing (determined in the e-invoice) compared to the average of the 3 months prior to the month of the obligation compared to the same period of the previous year.

As can be seen, most companies and entrepreneurs will benefit from this deferral.

How to access the fractional payment?

- Upon request on the Finance Portal (automatic validation), for companies and independent workers with a VN of up to 10M € in 2018, with activities closed or with start / restart of activity in 2019.

It is important to mention that each company will have to choose whether they want to pay in installments in 3 or 6 monthly installments.

What payments can be split?

- All IRS and IRC withholdings due on April 20, May 20 and June 20;

- VAT/ IVA payments:

- Monthly regime – on 15 / April, 15 / May and 15 / June

- Quarterly regime – May 20

- The first installment is due on the date of compliance with the obligation and the remaining installments are due on the same date, in the following months.

Graphically, deferrals will work as follows:

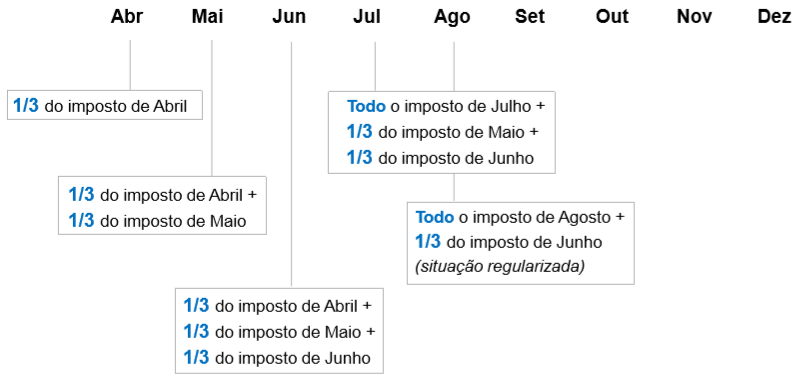

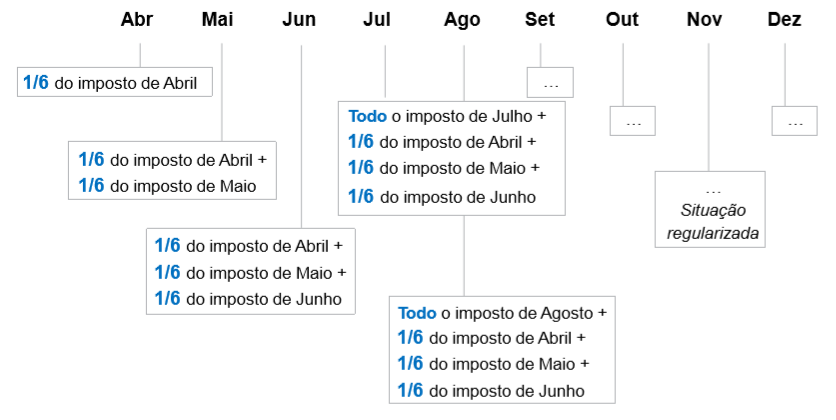

A – Withholding of IRS and IRC

Option 1 – Installment Payment in 3 Months

Option 2 – Installment Payment in 6 Months

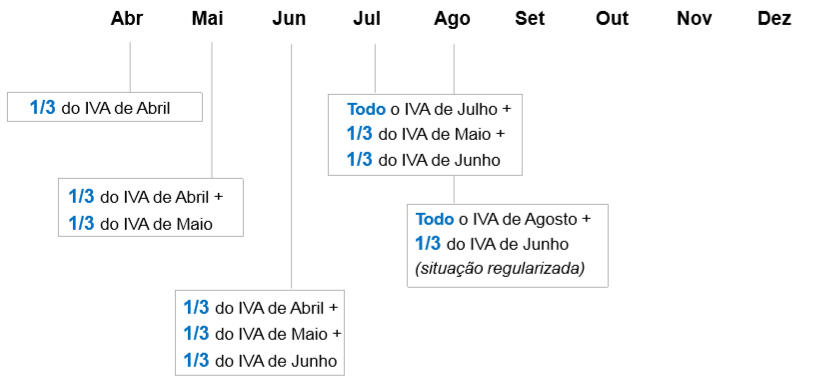

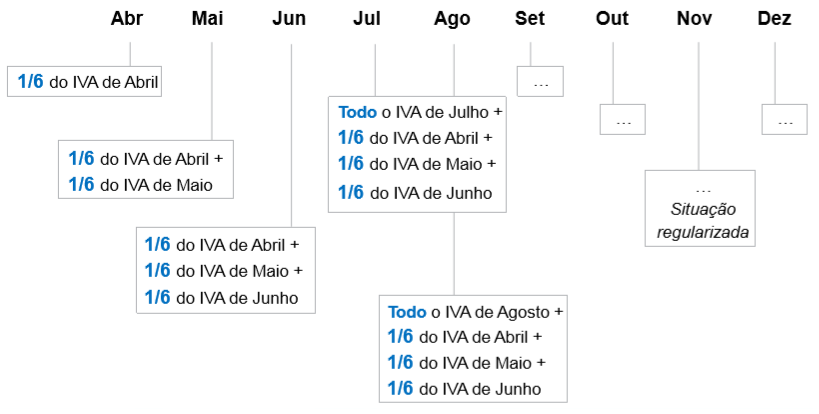

B – Monthly VAT

Option 1 – Installment Payment in 3 Months

Option 2 – Installment Payment in 6 Months

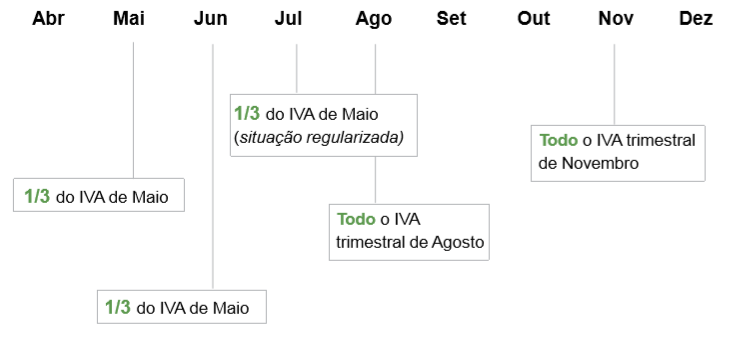

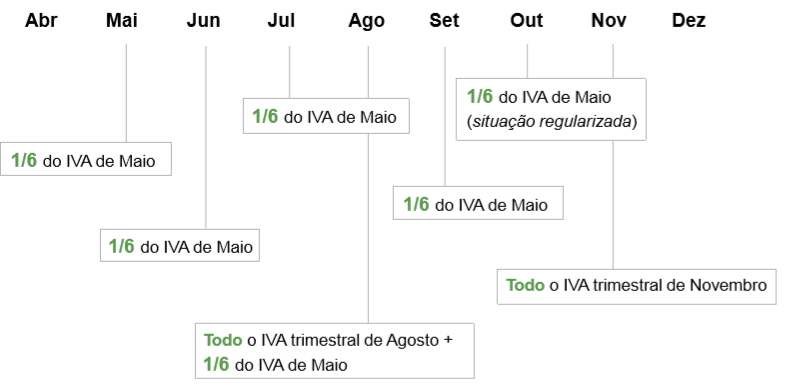

C – Quarterly VAT

Option 1 – Installment Payment in 3 Months

Option 2 – Installment Payment in 6 Months

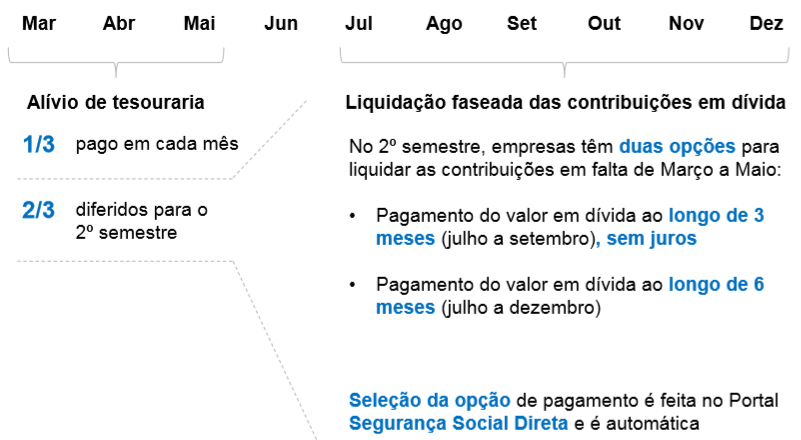

2 – Payment of Social Security contributions

Deferral of payment of social security contributions was also approved.

Who can benefit?

- Self-employed workers;

- All companies with less than 50 employees;

- All companies with 50-249 employees, provided they have a break of at least 20% of the turnover communicated through “E-Fatura” in March, April and May 2020, compared to the same period last year or so who started the activity less than 12 months ago, the average of the elapsed activity period.

How to access the fractional payment and the installment plan?

- Deferral of the payment of contributions under the employer’s responsibility is not subject to application. The allocation is automatic by the Social Security services;

- The employer must pay 1/3 of the amount of the monthly contributions in the due month and request, in July, a installment plan with the Social Security Direct;

- The billing requirements are demonstrated by the employer during the month of July 2020, together with certification from the company’s certified accountant.

What payments can be split?

- Social contributions payable by the employer due to 20 / March, 20 / April and 20 / May and to self-employed workers due to 20 / April, 20 / May and 20 / June;

- Companies that have already paid all of their March contributions may still defer payment of contributions due on 20 / April, 20 / May and 20 / June;

- Contributions must be paid as follows:

- One third of the value of contributions is paid in the month it is due;

- The remaining two thirds are paid in equal and successive installments: in the months of July, August and September (3 installments) or in the months of July to December (6 installments).

Important Note: A portion of the contributions relating to workers (11%) must be paid in the months when they are due and do not benefit from any deferral.

Graphically, deferrals will work as follows:

In the case of self-employed workers and companies that paid all contributions in March, the period shown in the image above as a cash relief is from April to June.

It is important to warn that all the installments referred to in this document will accrue in July and following months with the amounts calculated in those months, which may create financial difficulties.

You can find more information at the following locations: